Selling your property can be a daunting process, especially in today’s real estate market. But what if there was a way to streamline the process and get an immediate offer on your property? That’s where cash offers come into play. A cash offer for house can make the selling process quicker and more straightforward.

Following is a list of points that shed light on the intricate details of cash offer for house scenario:

- Definition of Cash Offer: It is an all-cash bid, indicating no loan contingency.

- Seller’s Advantage: Cash offers often speed up transactions, reducing the wait time.

- Buyer’s Edge: They can skip mortgage process, getting them closer to ownership faster.

- Making Successful Cash Offer: It involves proper research and realistic price estimation.

- Cash Offer Considerations: These include appraisal, home inspection, and closing costs.

- Pitfalls of Cash Payment: Lack of liquidity and potential for higher returns elsewhere are significant drawbacks.

- Role of Agents: Real estate agents can help identify legitimate cash buyers.

A cash offer for a house provides both the buyer and seller with unique advantages that could potentially speed up the overall process and minimize certain risks.

The Allure of Cash Offers in Real Estate

A cash offer acts as a potent tool for buyers to stand out in competitive markets.

Cash offers eliminate the need for mortgage approval, thus speeding up the transaction process.

For sellers, it minimizes financial risks as there’s no risk of buyer financing falling through.

However, it’s crucial to navigate this terrain with a seasoned real estate agent for the best outcomes.

Defining a Cash Offer in Real Estate

A cash offer in real estate refers to an offer where no mortgage financing is needed. The buyer has enough liquidity to cover the total price.

This type of transaction tends to be quicker and often more attractive to sellers, as there’s less likelihood for the deal to fall through due to financing issues.

The Attraction of Cash Offers

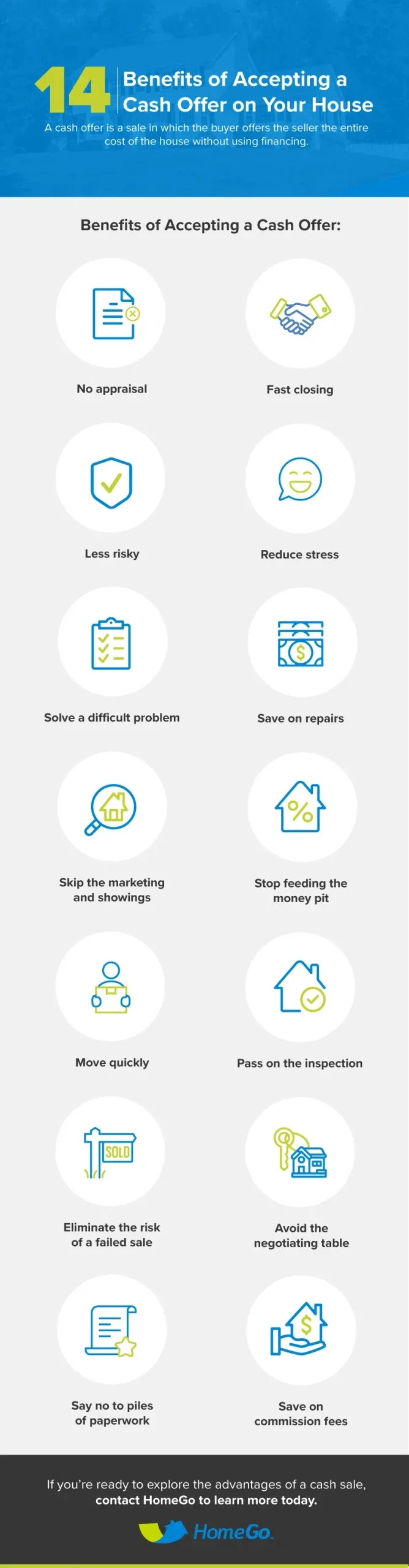

For sellers, cash offers are appealing due to their simplicity and speed.

The absence of loan approval processes means faster closing times, eliminating lengthy wait periods.

The deal also carries less risk of collapsing, reassuring sellers that the sale will indeed occur.

The Drawbacks

However, cash offers do have negatives. Buyers with ready cash may expect discounts, expecting concessions due to their strong position.

They might also rush the home inspection process, potentially overlooking potential issues just to expedite the transaction.

As a seller, it’s essential to weigh these pros and cons before making a decision.

Making Informed Decisions

Understanding cash offers can ensure you make educated decisions when selling property.

Familiarising yourself with this method helps you navigate potential challenges in real estate transactions.

For more information on this topic, you can visit Investopedia.

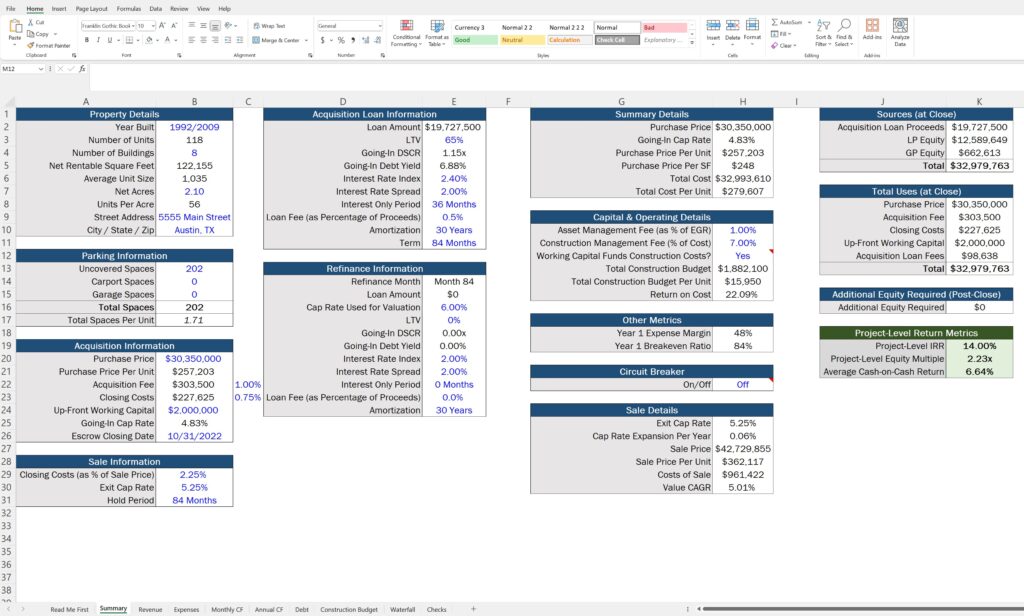

Advantages of Cash Offers for Sellers

When a buyer prepares a cash offer, it can make your sales process smoother. The lack of a financing contingency reduces the risk of the deal falling apart.

Also, with cash buyers, sellers can enjoy speedier closes, which are typically within one to three weeks. This compared to the average 43-60 days it takes when financing is involved.

- Reduced Risk: Cash offers often eliminate financial contingencies that may complicate or terminate deals.

- Faster Closing Times: A quicker close allows sellers to move on much faster than they would with traditionally financed buyers.

- Simplified Transactions: Fewer parties are involved in cash transactions, making them more straightforward.

In contrast to traditional sales, a cash offer’s simplicity reduces stress for sellers. You’re less likely to encounter transactional hurdles that might delay or derail the sale.

This convenience and speed make cash offers an attractive option for many sellers. It provides certainty in an unpredictable market.

Cash deals also reduce the need for appraisals and home inspections from lenders. Buyers can bypass these steps, further speeding up the process.

Cash offers don’t just benefit sellers; they’re good news for buyers, too. A cash offer can mean less red tape and quicker move-ins, making it a win-win scenario.

How Buyers Benefit From Cash Offers

Making a cash offer can provide several advantages for house buyers. One such benefit is the faster closing process.

Unlike mortgage-dependent purchases, cash offers don’t require lender approval, hence expediting the entire process.

You’re also likely to appeal more to sellers, as cash offers typically imply fewer complications and fall-throughs.

Moreover, you can save considerably on closing costs, which are often lower with cash transactions.

Last but not least, you avoid paying interest on a mortgage loan, leading to significant long-term savings.

| Benefits of Cash Offers | ||

|---|---|---|

| Quicker Closing Process | Seller Appeal | Fewer Complications |

| Lower Closing Costs | No Mortgage Approval Required | Savings on Interest |

| Less Risk of Deal Falling Through | No Loan Contingencies | Higher Bargaining Power |

| Reduced Paperwork | Immediate Equity in the Home | No Credit Checks Needed |

| Ownership Upon Payment Clearance | No Monthly Payments | No Private Mortgage Insurance (PMI) |

| Note: These benefits can vary based on individual circumstances. | ||

If you’re considering buying a house, remember that paying cash can bring these favorable conditions.

Steps to Making a Successful Cash Offer

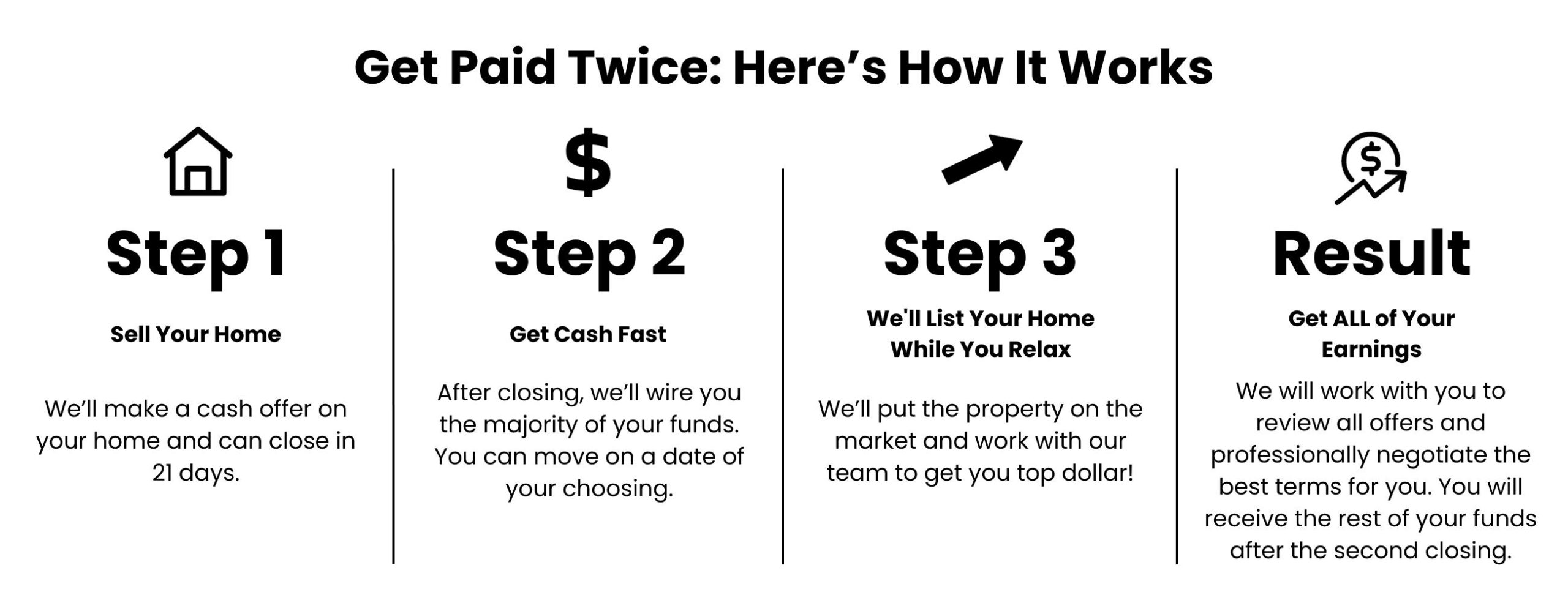

One essential step in making a successful cash offer is having confirmed funds ready. This gives sellers assurance and shows your seriousness.

Preparation is Key

An essential aspect of preparation is having your finances in order. This includes confirming that your funds are obtainable and readily available.

A pre-approval letter could be handy, though it isn’t necessary for cash buyers. It’s simply an extra layer of reassurance for the seller.

Negotiating the Offer

When negotiating, consider the home’s value and your budget. Do not make an unrealistically low offer as this may offend the seller.

Including a personalized note with your offer could make a difference. Sellers might be more inclined to accept offers from buyers who show personal interest.

Home Inspection and Contract Signing

Although you’re buying with cash, a house inspection is still crucial. It reveals any potential problems that might expense you later.

If the inspection results are acceptable, it’s time to sign the contract. Your realtor can guide you through this process effectively.

To get more tips, refer to this source.

Remember, patience and preparedness are valuable tools when you’re making a cash offer on a house.

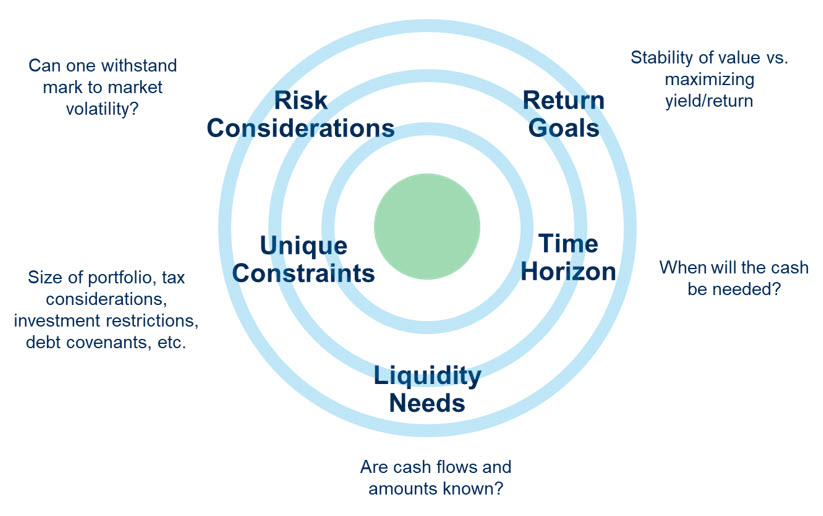

Considerations When Making a Cash Offer

Processing a cash offer for your house entails several considerations. It’s essential to approach it with knowledge and precaution.

- Appraisal Guarantee: With cash offers, there’s a reduced risk of the deal falling due to low appraisal. The selling price is usually accepted as is.

- Faster Closing: Cash deals tend to close faster. There’s no waiting for mortgage approval, dramatically speeding up the process.

- No Additional Costs: By making a cash offer, you avoid loan origination fees, appraisal costs, or any incidental bank charges.

- Reduced Stress: A cash offer lessens worry about buyer financing issues, providing a smoother transaction process.

These advantages position cash offers as preferred choices for hassle-free transactions. However, they do require careful scrutiny.

Learn more about these considerations on Quora.

It’s crucial to consider other potential challenges when accepting a cash offer. Ensuring the legality of the buyer’s funds is paramount.

- Funds Verification: Make sure the buyer’s funds are legitimate and readily accessible before entering into an agreement.

- Lack of Financing Contingency: This means if your buyer suddenly retreats, you’ll still have to navigate through the sale procedure again.

- Low-ball Offers: Cash purchasers might believe they’re entitled to significant discounts, leading to undervalued offers.

- Fraud Risk: Cash transactions may attract fraudulent buyers. Employing a trusted real estate attorney can help counteract this potential danger.

Armed with this information, you can confidently navigate through cash offers for your property.

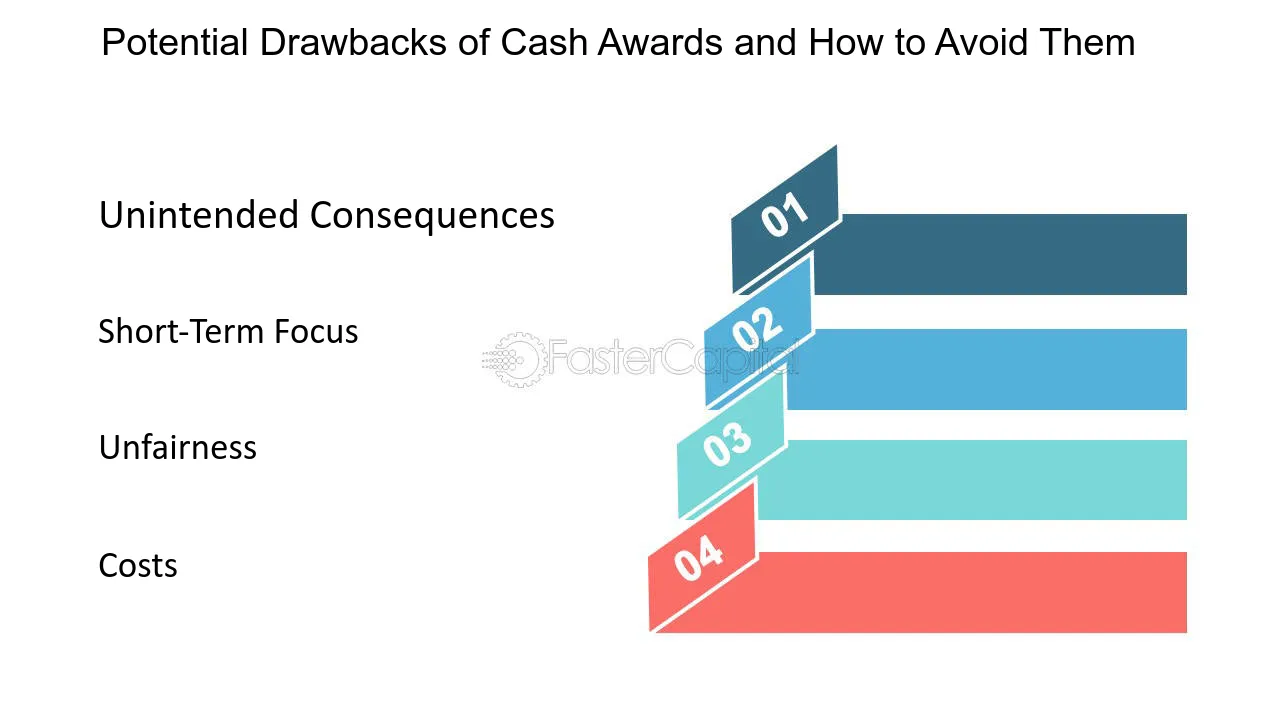

Potential Drawbacks of Paying With Cash

Paying with cash might seem appealing, but it also has potential drawbacks. The first of these concerns is the lack of a return on investment.

When you invest a large sum into a house, your money isn’t working for you in other potentially high-yielding investment opportunities.

The second potential drawback is the risk associated with tying up liquid assets. By investing substantial amounts of your cash into a property, you may find yourself in tricky financial situations should unexpected costs arise.

| Drawbacks | Explanation |

|---|---|

| Lack of Return on Investment | Money invested into a house could have been invested elsewhere for potentially higher returns. |

| Risk Tied to Liquid Assets | Large cash investments restrict immediate access to easily convertible assets during financial emergencies. |

| No Loan Interest Deductions | Homeowners who pay with cash miss out on tax deductions that come with mortgage interest payments. |

| Market Value Risks | A decline in property value can lead to significant losses if the property needs to be sold quickly. |

It’s crucial to consider these factors before making a major financial commitment such as buying a house in cash.

For further information and insights, you can refer to this related discussion on Reddit’s Zillow community here.

There are certainly pros and cons to consider, so make sure to do your homework, or even better, consult with a financial advisor.

Role of Real Estate Agents in Cash Offers

Real estate agents play a crucial role when dealing with cash offers. They can offer knowledgeable advice to navigate this process smoothly.

Expertise Resource

An agent may assist in evaluating an offer, ensuring that you’re not shortchanged and get the value of your property.

Streamlining Negotiations

Agents prove invaluable when negotiating terms with buyers. Their experience makes them capable of securing the best deal possible.

Faster Closings

A cash sale can mean a quicker closing. The agent’s role here involves coordinating the details to expedite the process.

Navigating Legalities

Real estate transactions involve legal nuances. A competent agent can guide you through these potential pitfalls, safeguarding your interests.

Identifying Legitimate Cash Home Buyers

Looking to sell your house for cash? It’s crucial to connect with a legitimate cash home buyer. Here is how you can identify them.

What are the hallmarks of a legitimate home buyer?

A credible home buyer should have a track record of successful purchases. They must be transparent about their service and provide practical timelines.

Can they provide proof of funds?

Legitimate cash buyers can present proof of their financial capacity to pay for your property. This is typically in the form of a bank statement or a letter from the bank.

Do they have positive reviews?

A reputable cash home buyer has positive reviews and feedback from previous customers. Make use of online platforms to vet them.

How responsive are they?

If they respond quickly to your queries and effectively communicate details, this indicates professionalism and reliability.

Journeying into the world of real estate need not be daunting. With these pointers, finding a legitimate cash home buyer is manageable. Be thorough with your research to avoid scams.

Cash Offer Explained

In essence, a cash offer on a house means a buyer proposes to purchase the property outright, without needing mortgage financing. This streamlines the selling process, eliminates the risk of loan denial, and can close deals faster. However, sellers should still vet cash buyers meticulously to avoid potential scams or unscrupulous dealings.