As one begins to plan for retirement, the consideration of cost becomes paramount. Falling into this framework, the search for affordable states to retire in the USA is a topic worth investigating. Here we’ll explore some of the most economical options for retirement locations within America.

Join us as we delve into an overview of these budget-friendly havens:

- Mississippi: Unbeatable Economy – A state that offers a cheap cost of living, especially for retirees.

- Arkansas: Golden Years Paradise – Known for its low housing costs and healthcare expenses.

- Oklahoma: Budget-Friendly Living – Boasts low costs on groceries and transportation.

- Michigan: Sound Economic Choice – Offers inexpensive housing and healthcare options.

- Alabama: Affordable Attractions – A state with low property taxes, perfect for retirees.

While these states offer various attractions, the common denominator among them is affordability, making them ideal choices for retirement life.

The Economical Retirement Option in the USA

By considering these affordable states to retire in the USA, you’ll be making an informed decision and giving yourself peace and comfort during your retirement.

Remember that an affordable lifestyle doesn’t mean sacrificing quality. These states offer various attractions from rich history to natural beauty, all at a cost that won’t strain your retirement fund.

Ultimately, choosing the right place to retire depends on personal preferences, but affordability should always be considered a major factor.

Understanding Retirement Affordability

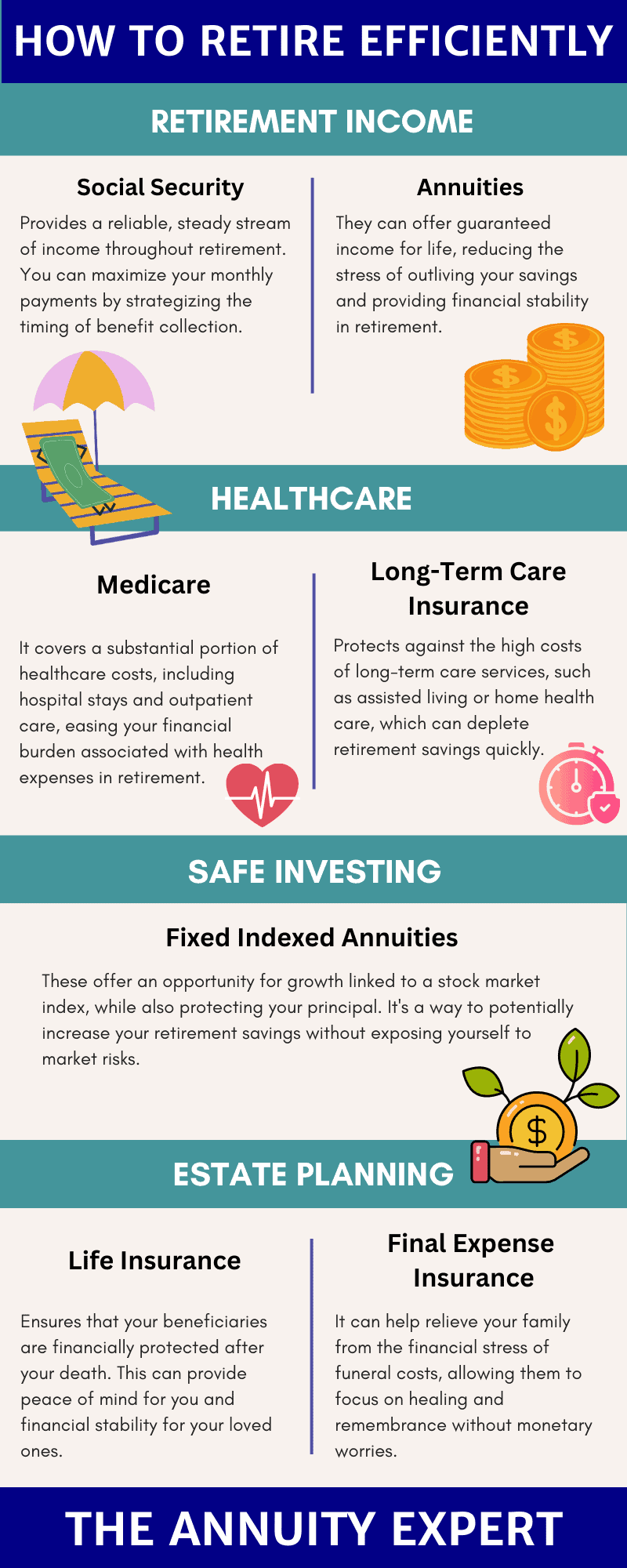

Planning for retirement is a significant step in life. It involves thorough consideration of your finances to ensure sustainability.

It’s important to factor in the cost of living, including housing, health care, groceries, and transportation.

Needless to say, choosing a state where these costs are relatively lower can help stretch your retirement dollars further.

| State | Housing Cost | Health Care Cost | Groceries Cost | Transportation Cost |

|---|---|---|---|---|

| Kansas | $125,000 | $6,500 | $3,500 | $4,000 |

| Oklahoma | $130,000 | $6,700 | $3,600 | $4,100 |

| Nebraska | $140,000 | $7,000 | $3,800 | $4,200 |

| Iowa | $155,000 | $7,500 | $4,000 | $4,400 |

| Table: Average Annual Costs in USD | ||||

| Category | US Average | Arkansas |

|---|---|---|

| Cost of Living | 100 | 79.0 |

| Housing | 100 | 61.1 |

| Healthcare | 100 | 88.4 |

| Groceries | 100 | 92.6 |

| Utilities | 100 | 91.8 |

| Data sourced from Forbes report. | ||

This data shows that Arkansas offers valuable opportunities for cost-effective retirement living.

Apart from cost, the region’s natural beauty with areas like Ozarks and Hot Springs, make it attractive to outdoor enthusiasts.

The state also has a warm climate, perfect for those looking to enjoy their golden years away from harsh winters.

In terms of healthcare, Arkansas has a good network of hospitals and clinics, offering comprehensive medical care.

The state’s social networks promote engagement with various community activities, fostering a sense of belonging among retirees.

Overall, Arkansas combines affordability and quality of life in a unique way, making it an excellent choice for retirement.

4. Michigan: An Economically Sound Retirement Option

Retiring in Michigan offers affordable living conditions. The cost of living index is considerably lower than the national average, making it highly desirable for retirees.

With reasonable housing costs and utility bills, Michigan provides an economically sound retirement option.

Moderate tax rates also contribute to its affordability. Michigan imposes a flat income tax rate of 4.25%, which does not burden fixed incomes that retirees typically depend on.

“Michigan’s flat income tax rate is friendly towards retirees’ budget.”

Apart from financial aspects, Michigan promises a serene retirement experience with its beautiful landscapes. The state boasts over 11,000 inland lakes offering tranquility.

Moreover, you have access to ample healthcare facilities. The University of Michigan Hospitals-Michigan Medicine ranks among the nation’s best for geriatrics according to U.S News.

You’ll never run out of social activities either. Community events, music festivals and sports events are a regular occurrence throughout the state.

Michigan combines affordability and quality lifestyle, making it an ideal retirement destination. More information about retiring in Michigan can be found here.

5. The Attractions of Retiring in Alabama

Offering affordability and warm climate, Alabama has become an attractive place for retirees. It provides a serene environment for a peaceful retirement.

Let’s not forget Alabama’s stunning natural scenery. With many outdoor recreational activities, retirees have the chance to embrace nature fully.

- Affordable cost of living: Alabama has one of the lowest costs of living in the US, which is appealing to retirees on a budget.

- Mild climate: The state enjoys year-round warm weather, which can be beneficial for those with certain health conditions.

- Natural beauty: From beautiful beaches to stunning mountainscapes, Alabama offers diverse landscapes for outdoor enthusiasts.

- Culture and history: Rich with historical landmarks and cultural hotspots, Alabama provides opportunities for lifelong learning.

Additionally, Alabama offers high-quality healthcare services. Numerous medical facilities in the state are adept at caring for an aging population.

The attractiveness of Alabama as a retirement destination extends beyond its affordability. Its natural and cultural wealth adds richness to one’s retirement years.

The culinary delights from Southern cuisine are another reason why retirees flock to Alabama. The food culture here is something that needs to be experienced firsthand.

Remember, making an informed decision is crucial for your retirement planning. For more insights, visit Business Insider.

The folksy charm and hospitality characteristics of the state will make anyone feel at home immediately. Indeed, retiring in Alabama can be a fulfilling experience.

6. Missouri: Ideal Spot for Thrifty Retirees

If you’re a retiree on a budget, Missouri might just be the place for you. The state offers a low cost of living and reasonable property taxes.

Enjoy Affordability in Missouri

The Show-Me State presents an affordable lifestyle without compromising comfort.

With cheaper housing options than the national average, your retirement fund can go a long way here.

Thriving Cultural Scene

Despite its affordability, Missouri does not lack in cultural and recreational offerings.

From wineries to parks and museums, there’s plenty to explore and enjoy.

Social Security Income Friendly

Missouri is also kind to your social security income. It refrains from taxing it, thus stretching your retirement budget even further.

If frugality is high on your agenda, this could be a crucial consideration.

In conclusion, retiring in Missouri means making the most out of your budget while enjoying plenty of activities and a rich culture.

7. Tennessee’s Low-Cost Retirement Lifestyle

Why is Tennessee an affordable state for retirement?

Tennessee boasts a cost of living below the national average, making it an attractive option for retirees.

Its low housing costs and utility prices contribute to a budget-friendly lifestyle.

What about healthcare costs in Tennessee?

Healthcare in Tennessee is relatively affordable.

The state has several Medicare Advantage plans to fit various budgets.

How does the tax system impact retirees?

Tennessee has no state income tax, further reducing living costs.

This tax benefit extends to most kinds of retirement income.

Is there entertainment for seniors in Tennessee?

Tennessee offers diverse cultural experiences, from music festivals to historical tours.

Outdoor enthusiasts will enjoy the state’s numerous parks and hiking trails.

Are there specific communities for retirees in Tennessee?

There are numerous retiree-friendly communities across the state.

These areas often provide amenities designed with retirees in mind.

8. Georgia: A Sweet Spot for Retirees

Noted for its low cost of living, Georgia is a top choice for retirees seeking an affordable place to settle down. The Peach State offers reasonable housing prices.

This southern state also has a relatively low median home value, making it easier for retirees to find a suitable home within their budget.

- Low property taxes: Georgia’s property taxes are among the lowest in the nation, which can help retirees stretch their budget.

- No tax on Social Security: Retirees will appreciate that Georgia does not tax Social Security income.

- Sales tax rates are reasonable: At just 4%, the state sales tax will not drain retirees’ pockets.

Beyond finances, Georgia’s mild climate is an added bonus. With warm winters and hot summers, you can enjoy outdoor activities year-round.

If you need more information on tax-friendly states for retirees, I recommend checking out this article on Kiplinger.

In addition to affordability, Georgia offers a rich cultural heritage. With historic sites, breathtaking landscapes and exciting cities, there’s plenty to explore in your golden years.

9. Delighting in Low Retirement Costs of Indiana

The affordability of Indiana makes it a popular choice among retirees.

With a low cost of living, retirees can enjoy their golden years without financial worries.

Affordable Housing in Indiana

Housing is a significant factor in the decision to retire in Indiana.

Low property prices make owning your dream retirement home attainable.

Cost-effective Healthcare Services

Healthcare is another key consideration for retirees. The state offers cost-effective healthcare services compared to other states.

This makes it more suitable for those who anticipate more health care needs as they age.

Low Cost of Living

The overall cost of living in Indiana, including groceries and utilities, is lower than the national average.

This enables retirees to have a comfortable lifestyle without breaking the bank.

10. Kansas: Attractive Destination for Budget-Conscious Retirees

Kansas offers a welcoming landscape for retirees on a budget. Unmistakably, its lower-than-average cost of living marks it as attractive.

With affordable housing options, Kansas stands out. Retirees can enjoy a comfortable lifestyle even on conservative budgets.

Healthcare, an important consideration for retirees, is relatively inexpensive in Kansas. It assures peace of mind for many seniors.

Besides fiscal benefits, Kansas boasts diverse recreational activities. These range from stunning outdoor trails to vibrant cultural festivals.

The Sunflower State’s warm community spirit is another plus. It’s easy to mingle with locals and make new connections.

The low taxes here are also noteworthy. They help stretch retirement income further, making life easier for retirees.

Kansas punches above its weight when it comes to retiree-friendly services. With strong community programs, seniors are well catered for.

It’s not just about money either. Data compiled by Investopedia shows Kansas scores well on safety too.

Retirement Value!

For those planning their golden years, the most affordable states to retire in the USA are a mix of Midwest charm and Southern hospitality. These regions provide low cost of living, great healthcare, and engaging lifestyles. Consider Mississippi, Arkansas, Oklahoma, Missouri, and New Mexico as top choices for cost-effective retirement living.