When it comes to selling a home, a cash offer can be a game-changer. Receiving a cash offer for your house can make the process smoother and faster, eliminating many potential obstacles that come with traditional financing.

Here are some essential points to consider when dealing with cash offers for houses:

- The Attractiveness of Cash Offers: Cash offers often appeal more to sellers due to their quick and hassle-free nature.

- Defining a Cash Offer: A cash offer is when a buyer proposes to purchase property without needing financing.

- Cash Offers in the Current Market: In today’s competitive housing market, cash offers stand out.

- Speed of Transactions: Cash offers expedite the closing process significantly.

- Cash vs. Traditional Offers: Unlike traditional financed offers, cash offers don’t risk falling through due to loan denial.

Understanding these key elements can provide you with a thorough idea of the dynamics around a cash offer for a house.

The Impact of Cash Offers on Real Estate Transactions

Cash offers give buyers an upper hand in competitive markets, allowing them to make an attractive proposition to the seller.

Sellers can benefit from reduced sale timelines and the assurance of an immediate, secure payment.

Real estate agents can leverage the benefits of cash offers to negotiate advantageous deals for their clients.

In conclusion, considering a cash offer for your house can simplify and accelerate the selling process, providing an efficient alternative to traditional financing methods.

The Significance of Cash Offers

An all-cash deal involves a direct exchange of cash for an asset, with real estate being a primary industry using this approach.

The buyer provides the seller with the decided amount through checks or wire transfers, negating the need for financing.

In such deals, the funds are transferred without any intermediaries such as financing agencies or share exchanges.

- Efficiency: A cash deal simplifies the buying process. It eliminates the need for loan approvals, thus accelerating the transaction process.

- Funds Certainty: The seller has a guaranteed payment at their disposal, reducing the risk of deal failure.

- Negotiating Power: Cash offers provide buyers with leverage, potentially resulting in a lower purchase price.

- No Financing Cost: By paying in cash, buyers eradicate costs associated with taking out a loan.

To ensure an all-cash deal is worth your while, it’s important to conduct thorough due diligence as recourse may be limited if issues arise.

Payment in cash has both pros and cons. Sellers get a certainty of closure, while buyers can negotiate better prices free from financing costs.

You can read more about all-cash deals on Investopedia.

If you’re considering this method of purchasing, make sure you’re equipped with sufficient information to make an informed decision.

Attractiveness of Cash Offers for Sellers

There’s an undeniable allure in cash offers for house sellers. The primary reasons are the speed and simplicity it offers. Unlike mortgage-dependent transactions, cash deals close much faster, reducing uncertainties.

All-cash buyers present a certain level of seriousness and reliability. Their purchasing power doesn’t hinge on external financing, which is beneficial to sellers.

Cash offers are viewed favorably due to their ability to bypass lender problems. The risk of a deal crumbling during the underwriting process greatly diminishes.

- Speedy transactions: Cash deals are faster because they aren’t contingent on mortgage approval, causing less delay.

- Risk reduction: The chances of a deal falling through due to financing issues is negligible in cash transactions.

- Simplicity: Cash transactions’ predictability and reduced complexity make them more attractive to sellers.

Sellers value these advantages and may be open to negotiating terms like price to balance them. The elimination of loan approval complications decreases potential risks, making cash offers more appealing.

What Defines a Cash Offer?

A cash offer for a house signifies that you’re ready to purchase the property using your personal financial resources, without the need for a mortgage. These resources could be from your personal wealth, proceeds from the sale of other assets, or even from a cash-out refinance.

In real estate transactions, cash offers hold more appeal for sellers as it eliminates the uncertainties and delays that come with mortgage approvals. This speeds up the closing process and reduces associated fees.

Considering a Cash Purchase

Purchasing a house with cash requires an in-depth assessment of your financial situation since there’s no lender to evaluate your debt-to-income ratio. Here are certain factors to consider:

| Factors |

|---|

| Regular monthly expenses |

| Property taxes |

| Six months’ worth of emergency funds |

| Moving costs and necessary upgrades |

You must ensure you have enough funds left after the purchase.

Another important consideration is how purchasing a house with cash impacts your long-term financial goals, especially regarding retirement savings.

Tax Implications and Future Loans

Paying all cash for a property means you won’t have a mortgage loan and the accompanying interest payments. However, this also means you can’t claim the mortgage interest deduction to lower your tax bill.

If you plan on applying for a mortgage—purchase or refinance—or personal loan in the future, buying a house with cash decreases available funds for down payments or repayments.

Alternative Investments

Before deciding to buy a house with cash, evaluate other potential investments. The risks and rewards of each must be examined carefully. Consult with a financial advisor or wealth manager before making your decision.

For more information on this subject, you can read this article from U.S. News Real Estate.

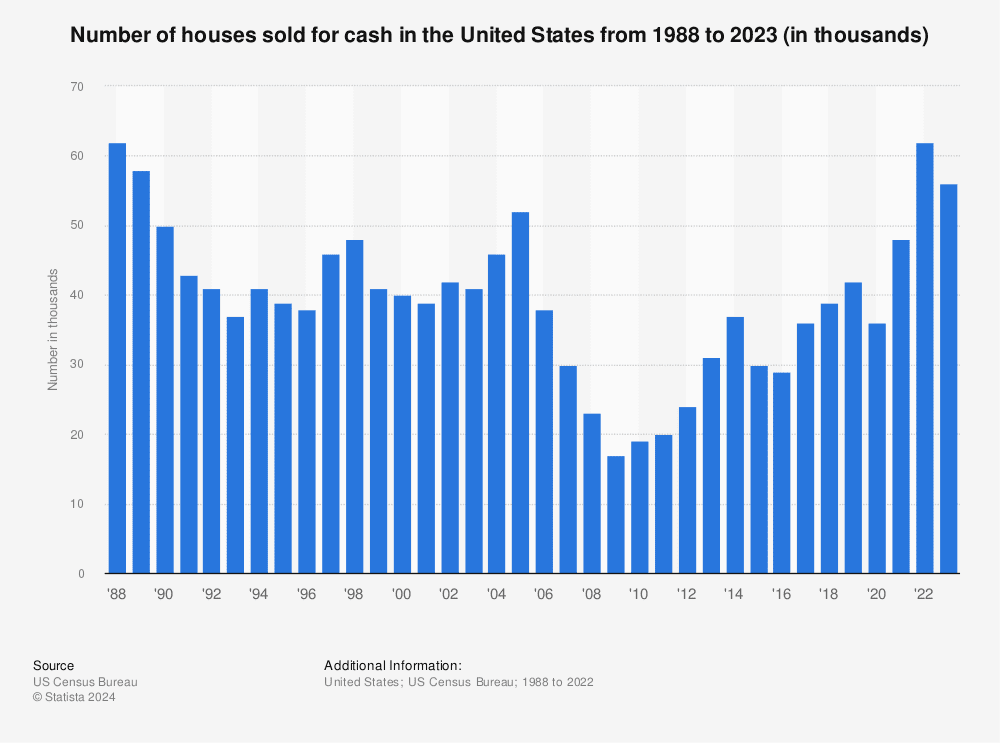

Cash Offers in Today’s Market

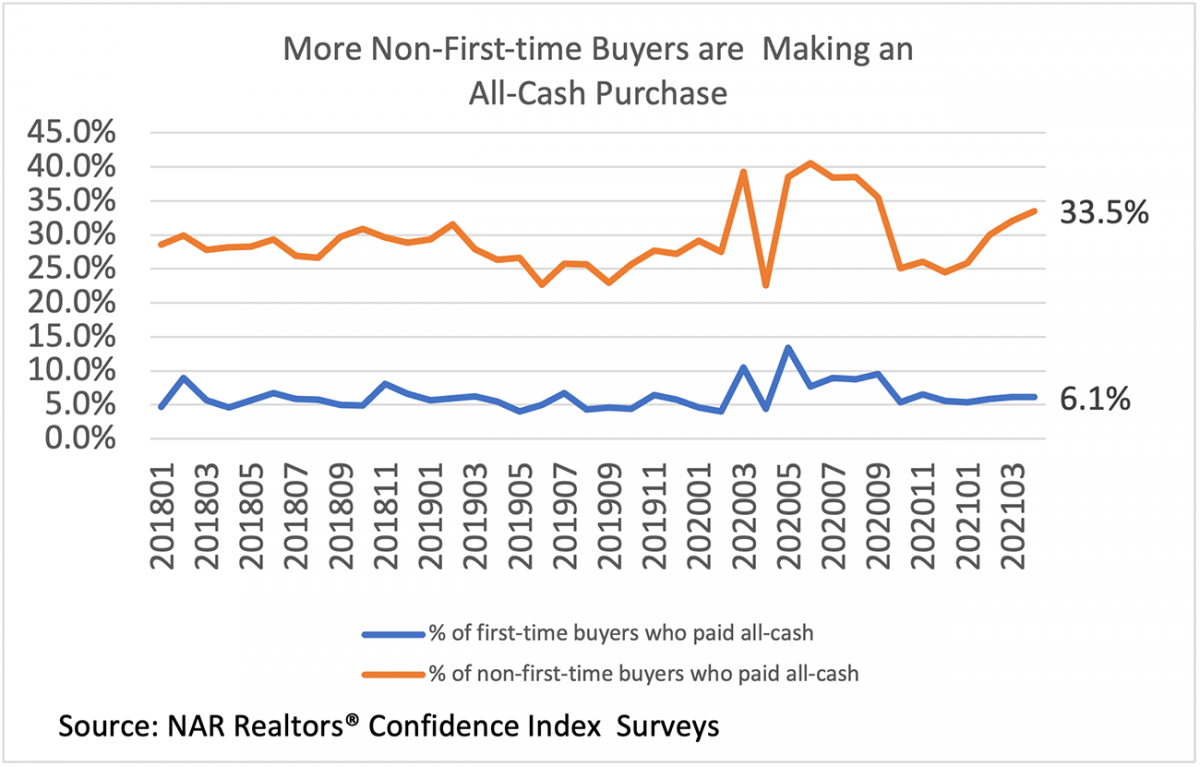

Why is there a surge of all-cash purchases in the housing market?

Recently, an influx of cash-rich buyers, such as affluent individuals and investors, has disrupted the housing market.

This shift has created an uneven terrain where these buyers often outshine their mortgage-reliant counterparts.

Where can you see significant increases in all-cash purchases?

Certain regions exhibit a steep rise in all-cash transactions. For example, nearly 40% of home purchases in Frederick and Montgomery counties in Maryland are cash-based.

Similar trends are noticeable around New York City, specifically in Nassau and Suffolk counties, with over half of the homes being bought outright.

What are the implications for traditional home seekers?

Conventional buyers often find themselves priced out by all-cash offers that don’t hinge on mortgage financing.

This becomes increasingly common as mortgage interest rates rise, thus complicating scenarios for those requiring financing.

How does the cash purchase trend affect the U.S. housing market?

All-cash transactions account for an estimated 34.1% of U.S. home purchases, according to a report by Redfin.

Paying upfront makes these buyers favorable to sellers, further straining inventory for those reliant on financing.

Who are these cash buyers typically?

Real estate agents report that these cash purchasers are typically retirees, investors, or high-income individuals.

The ability to outbid traditional buyers often leads to the displacement of existing residents in areas like Naples, Florida.

How Cash Offers Speed up Transactions

If you’re a home seller, accepting a cash offer can expedite your transaction process substantially. The main reason being, it minimizes the risk of financing-related fall-throughs.

Once an offer is accepted, your house is essentially off the market. This leaves room for back-up offers but primarily, a fast and secure closing is what every seller aims for.

Cash offerings play a pivotal role here. They are not only faster but also provide a sense of security in real estate transactions.

“Cash deals are like a safety net in real estate transactions, ensuring faster closings and minimizing risks.”

On comparison with traditional finance deals, cash offers stand out due to their quick turnaround time. This adds significant value both for sellers desiring swift closures and buyers keen on moving in promptly.

To understand more about cash deals and their impact on real estate transactions, visit this informative article.

Comparing Cash Offers With Traditional Offers

Purchasing a home with cash significantly empowers your negotiating abilities. Ordinarily, sellers are more drawn to cash offers as they present fewer complications and uncertainties.

With quicker closing times, you can potentially bargain for better sales terms, including price reduction. Cash transactions often close within 1-2 weeks, giving them the edge over mortgage-based sales which typically take 30-60 days.

- Negotiating Power: Being a cash buyer places you in a strong position to negotiate on price and terms.

- Certainty: Cash transactions eliminate the risk of a lender denying financing, making the sale a more secure proposition for sellers.

- Less Complications: With no lender involvement, there’s less paperwork facilitating a streamlined process. The reduced number of parties also minimizes logistical issues.

- Speed and Efficiency: A cash transaction is generally quicker and requires less effort from all parties involved.

In addition to these benefits, paying in cash also allows for immediate possession once the transaction is finalized. This means you gain access to your new property quicker than traditional mortgage buyers.

An often overlooked advantage of cash transactions comes in the form of cost savings. By not involving a lender, fees for origination or title insurance can be avoided. Plus, without a mortgage, there’s no accumulated interest to pay over the life of the loan. You can learn more about this topic at The Balance Money.

In conclusion, these key differences show why both buyers and sellers find cash transactions to be a desirable option.

Pros of Accepting a Cash Offer

Accepting a cash offer on your house often leads to a quick, smooth transaction. You can bypass the formalities and uncertainty that come with traditional financing.

Cash sales eliminate the risk of loan denials late in the process, saving both the buyer and seller wasted time and money.

No Need for Showings

With cash offers, you can avoid the inconvenience of multiple showings. You save time, reduce stress, and maintain privacy.

Sell Your House Faster

Speed is a significant perk with cash offers. Buyers can close the deal quicker without lenders’ delays.

Avoid Complications

In a cash sale, there are fewer contingencies to worry about. This simplicity reduces complications and potential hindrances.

An all-cash offer from Opendoor, a trusted partner, presents an effective solution for those who want to maximize efficiency when selling their house.

Reliability on Offer

Cash buyers usually have funds ready, making them reliable. This certainty often aids in enhancing your sale experience.

Tailored Solutions for Sellers

Cash selling provides tailored solutions that cater to individual needs, creating a rich user experience by providing value without dragging out the process.

Overcoming Sellers’ Apprehensions About Cash Offers

Navigating the real estate market can feel daunting. An overwhelming concern for many is the expense, with relocation costs surprising half of Americans in 2023.

The Appeal of Cash Offers

Cash offers present an attractive alternative. They simplify transactions and can save considerable money. However, apprehension prevails among sellers, adding complexity to decision-making.

Selecting a reliable service is key. Clever Real Estate partners with Home Bay to offer a free service that instills confidence while ensuring minimal cost in buying or selling properties.

Understanding Online Estimators

Online home value estimators have gained popularity. Two prominent providers are Zillow and Redfin, each promising accuracy and convenience to users. However, understanding how these estimators work can often be perplexing.

Interestingly, selling your home independently on sites like Zillow might appear cost-effective initially but could result in unforeseen expenses down the line.

Realtor Commissions Explained

A common query surrounds realtor commissions. The average commission is 5.49% of the home’s sale price, but it varies by state and is always negotiable.

You may consider linking up with full-service agents who can help you save thousands on commission fees. Such services are readily available through Home Bay.

Remember, you don’t have to navigate this complex landscape alone. Reach out to industry professionals for accurate information and helpful advice as you make these important decisions.

How Cash Offers Impact Property Values

Cash offers on homes can significantly affect property values. It’s crucial to acknowledge the sellers’ priorities when considering cash options.

A swift close or an extended stay might be at the top of their list. Understanding these factors can play a crucial role in your dealings.

- Secure Mortgage Preapproval: Secure preapproval before making your offer. This will reassure the seller about your financial stability.

- High Price and Larger Down Payment: Bidding higher and offering a hefty down payment could make your deal more appealing compared to all-cash offers.

- Waive some contingencies: Removal of potential barriers might sweeten your offer for the seller.

- Elevate Your Earnest Money Deposit: Show your commitment towards purchase by raising the deposit, thereby decreasing the risk for the seller.

Establishing a personal connection with the sellers could also work to your advantage. Including a heartfelt letter with your offer can make a significant difference.

The transaction process must be direct and uncomplicated. Meticulous planning can help avoid unnecessary demands and friction with the sellers.

Refer here for more insights on how cash buyers often pay about 10% less than mortgage buyers, due to their offer’s convenience and certainty.

Reducing friction between mortgage buyers and sellers could simplify closing escrow. By providing clear statistics on mortgage success rates, you’ll inform sellers about potential risks and timeframes.

Crafting an attractive mortgage offer in a market dominated by all-cash proposals requires strategy and foresight.

The Role of Real Estate Agents in Cash Offers

Despite cash buyers not requiring a mortgage lender, engaging a real estate agent is crucial. The expertise of an agent aids significantly in negotiating terms and drafting the purchase agreement.

Real estate agents are pivotal in obtaining appraisals and managing complex elements associated with cash offers. Sellers typically cover the agents’ fees, making it a cost-effective strategy for the buyer.

Agents offer critical support throughout your home buying journey. This includes ensuring the entire process is smooth, from viewing potential homes to finalizing the legal paperwork.

A reliable real estate agent can be vital to an enjoyable home buying experience. They provide invaluable assistance, whether you’re dealing with simple inquiries or resolving unforeseen issues.

You might consider connecting with an esteemed Premier Agent from reputable platforms like Trulia for an enhanced service experience. These agents meet stringent standards and work tirelessly to ensure you receive personalized and quality service.

Their proficiency can not only help save time but also ensure that your purchase agreement is well-drafted and your property accurately appraised. Thus, leveraging a real estate agent’s knowledge is indeed a prudent decision when making cash offers.

Cash Offers: Myths vs. Reality

There’s a common misconception around the real estate investing scene. It’s widely believed that getting into this business requires a hefty amount of savings in your pocket.

Reality paints a different picture, though. The truth is that starting in real estate investing isn’t exclusive to those with thick wallets. Various financing options are available such as traditional mortgages, private financing, or even seller financing. There are also methods such as house hacking where you can take advantage of existing resources.

| Myth | Reality | Strategy |

|---|---|---|

| You need a fortune to invest. | No significant capital required. | House hacking, partnerships. |

| You must be a millionaire to start. | Accessible entry points exist. | Multifamily investments, resource pooling. |

| A large capital is mandatory. | Different strategies require minimal upfront investment. | Wholesaling, flipping. |

| You can’t invest without substantial savings. | Numerous financing options available. | Mortgages, private lending. |

| Real estate is for the rich only. | Wealth isn’t a prerequisite to begin investment journey. | Seller financing, private financing. |

| Table: Myths and Realities of Cash Offers in Real Estate | ||

This information should help dispel some misconceptions and give room for positive action. For more details, visit this page.

Typical Cash Buyers in Real Estate Market

The real estate market hosts a diverse range of cash buyers. From private lenders who offer funds to potential homebuyers, to wholesale investors who buy properties outright for later resale.

Real estate agents too often operate as cash buyers, employing their industry knowledge to make savvy purchases. Similarly, rehabbers buy homes to renovate and sell them at higher prices.

The Professional Real Estate Player

Real estate brokers, much like agents, use their extensive networks and industry expertise to find worthwhile investment opportunities. House flippers operate on a short-term basis, buying properties, enhancing them for quick sell-off.

Buy-and-hold investors, on the other hand, purchase properties with the intention of keeping them for an extended period. They typically generate income through rentals or wait for an appreciation in the property’s value.

Institutional and Individual Investors

National and local hedge funds often invest huge sums in real estate, hoping for significant returns over time. Property managers may also invest in properties they manage, seeing first-hand the potential benefits before others do.

Individual investors and self-directed IRA holders represent everyday people investing their savings into real estate. They commonly aim for long-term stability rather than quick gains. You can learn more about these cash buyers from Bigger Pockets Blog.

Specialized Real Estate Investors

Other key players include rent-to-own investors who buy homes intending to rent them out with the option of selling to tenants later. There are also real estate trusts that pool together investments from multiple parties to invest in commercial properties.

Private mortgage note buyers, in essence, invest in the debt of a property rather than the property itself. They buy mortgage notes from lenders for an upfront cash payment.

Cash Offer Advantages

As a seller, accepting a cash offer for your house offers immense benefits. It guarantees a faster sale, eliminates the risk of loan fall-throughs, and reduces paperwork. This not only saves time but also provides immediate financial relief. Thus, a cash offer often equals a smooth, efficient, and stress-free transaction.