Selling your house in Texas requires a solid understanding of the local real estate market and its unique challenges. From recognizing peak selling seasons to understanding price variations from month to month, it’s vital to be knowledgeable about the Texas housing market.

As we delve into the details of how to sell your house in Texas, here are some key points to consider:

- Grasping Market Trends: A crucial step towards achieving a successful sale.

- Peak Selling Seasons: Identify when buyers are most active.

- Price Variations: Understanding how prices fluctuate helps optimize your selling price.

- Housing Market Factors: Be aware of factors influencing the Texas housing market.

- Benefits and Risks: Weigh the pros and cons of selling in different seasons.

We’ve covered some broad points on how to sell your house in Texas. Now, let’s explore more specific ways to make the most out of your sale.

Navigating the Texas Real Estate Market

Firstly, it’s essential to have a clear understanding of market trends. This can help guide your decisions regarding when and how to sell your house in Texas.

Additionally, be mindful of the peak selling seasons. These are typically when potential buyers are most active, enhancing your chances for a profitable sale.

Lastly, it’s important to be aware of any external factors that could impact housing prices within the state. Things such as natural disasters or shifts in the local economy can significantly affect the value of your home.

Understanding the Market Trends

As of July 2024, experts advise home sellers in Texas not to dawdle. Higher mortgage rates might cause a market slowdown.

Comprehensive reports on economy and housing market conditions are accessible on realtor.com.

Metrics for various geographical levels, down to zip codes, are provided by MLS-listed for-sale homes data library.

Higher mortgage rates could reduce the number of ideal homes available to buyers.

The Weekly Housing Trends Reports provide inventory metrics like the number of newly listed homes.

The Freddie Mac Rate experienced some fluctuations, from 6.47% down by 0.26 percentage points, and later to 6.73% after dropping 0.05 percentage points.

High mortgage rates have negatively impacted Homebuyer Confidence. Buyers are not as confident as they were before.

The July Jobs Report indicates a significant slowdown in payroll growth with only 114,000 job additions.

The Federal Reserve Rate remains within the 5.25 – 6.25% range.

Newly Listed Homes show an increase by 12.2% year-over-year. A promising increase despite the overall market challenges.

Six major markets saw decreases in Median Home Prices; Miami, San Francisco, Kansas City, Denver, Oklahoma City and Seattle.

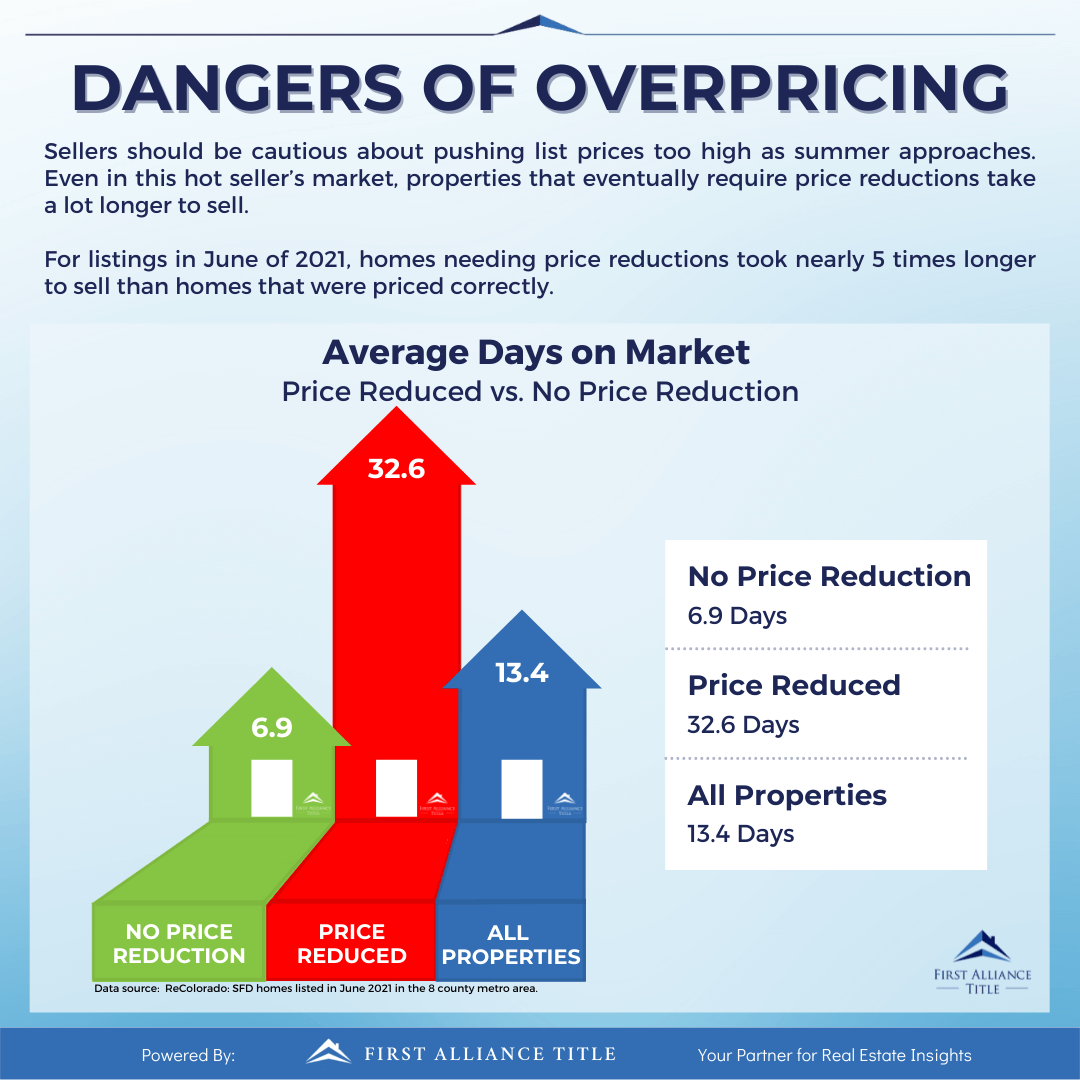

In 44 out of the 50 largest metropolitan areas, there were increases in Price Reductions.

Various regions and cities across the U.S provide detailed Regional Market Trends data.

Universality of Peak Selling Seasons

The summer vacation rental market has seen an uptick in vacancies and prices, thanks to homeowners increasingly marketing their properties as short-term rentals. This trend has inflated the available supply.

The change in booking patterns, precipitated by two years of record demand, has caused slight declines in 2023 bookings. However, this situation is viewed as a corrective measure after demand-related cost inflations.

Adapting to Market Corrections

Despite elevated vacancies, rental prices are maintaining. The persistent high demand for vacation rentals indicates a favorable seller’s market. The market is adjusting to the increased demand and inventory.

According to AirDNA’s U.S. market review, short-term vacation rentals saw a 12.6% rise in April year-on-year. Additionally, there was a 16.4% increase in bookings.

Seller Negotiations amidst High Demand

As inventory continues to increase, owners might negotiate bookings. However, the decreased bookings have not triggered severe price reductions. Changing travel preferences and destination expansion contribute to this shift.

This insight into the vacation rental landscape helps potential sellers gauge the best time and price to sell their properties.

Rising Vacation Rental Bookings

The summer season is slated to be the largest yet for the vacation rental market. Despite dips in bookings, vacation rental demands continue to soar.

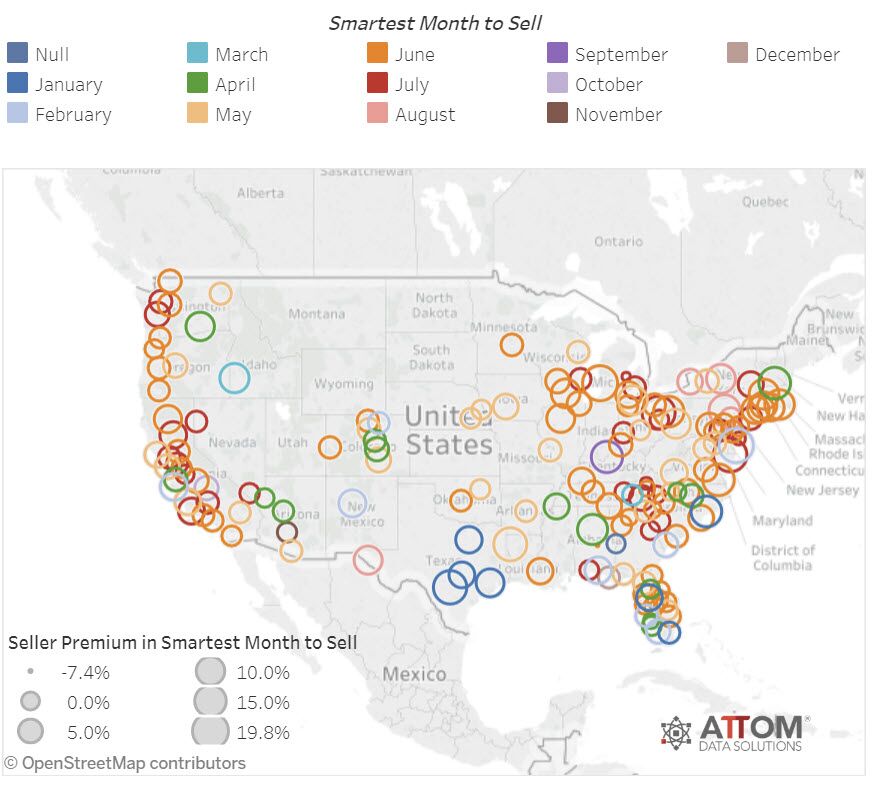

Best Month to Sell in Texas

Zillow suggests March as the prime time for listing houses in Texas. The goal is a quick sell, and history shows March achieving this.

But it wasn’t always this way. Traditionally, May was the golden month for real estate sales. However, recent trends have shifted favor towards March.

The weeks of March 11 and 18 proved particularly favorable in 2019 for swift home sales.

- If your objective is a sale above asking price, aim to list during the week of April 22nd.

- Avoid listing post-Labor Day, when families are settling in for the school year.

- List before September starts to maximize chances of a profitable sale.

- Beware of October! The weeks of October 14 and 21 are unfavorable for sellers seeking to gain beyond their asking price.

Note that data aberrations from 2020 have been disregarded in these analyses. Zillow provides more context on these insights here.

Selling your house requires strategic timing. Use these tips to heighten your chances of an expedient and profitable sale in Texas.

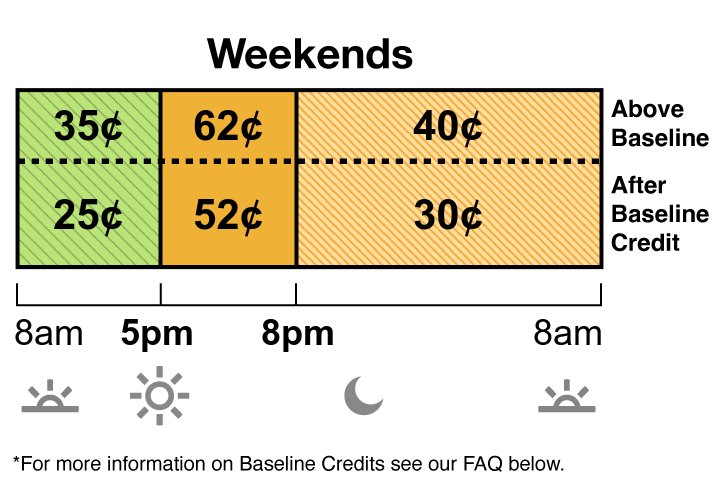

Price Differences in Peak Months

High prices of essentials like milk and coffee have caused concern among consumers, leading to complaints about overall inflation.

Despite recent cooling of inflation, dissatisfaction over grocery prices remains high.

| Product | Price Increase |

|---|---|

| Coffee | Significant |

| Milk | Notable |

| Bread | Moderate |

| Butter | Mild |

This table highlights the increases in prices of staple groceries.

The price hikes of milk and coffee, everyday items for most households, are particularly significant.

Understanding Grocery Price Inflation, helps to make sense of these concerns.

Despite the decrease in overall inflation, these high costs continue to affect consumer sentiment.

Grocery prices remain a major concern due to their impact on household budgets.

Factors Influencing Texas Housing Market

The Texas real estate landscape is impacted by supply and demand dynamics, affecting prices and sales volumes.

There’s been variation in listings, with a noted rise in home inventory to 3.7 months in Q3 2023 from the previous year’s 2.7 months. This could indicate a shift to a buyer-friendly market.

- Average home price: The median home price in Texas stands at $352,700, comparatively low against the national median, making the market more accessible for prospective homeowners.

- Sales Volume: There’s been a slight dip recently, with increased interest rates resulting in a 1.5% price drop from Q3 2022 to Q3 2023, potentially impacting future sales and inventory.

- Market Predictions: Some areas of Texas may face a downturn, with one region predicted to see an 8.9% decrease in house prices by November 30, 2024.

- Data points: Key statistics include home price trends, rental rates and sales volumes – useful indicators of market demand and economic factors.

The Texas Quarterly Housing Report, released four times a year provides crucial insights from nearly 50 markets across Texas. This helps stakeholders stay updated with market trends on both monthly and quarterly basis.

Benefits of Selling in Peak Season

Selling your house during peak seasons aligns with customers’ buying preferences. This tactic maximizes revenue from surges in demand.

Bursts in Revenue

Getting your timing right will prevent you from missing significant revenue opportunities. If selling and buying seasons misalign, it may result in lower sales and profitability.

Proper timing can influence the average order value, stimulate more transactions, increase conversion rates, and enhance customer satisfaction.

Optimized Inventory and Pricing

Understanding the peak buying season is important for stocking up on preferred items. It assists in optimizing pricing strategies and developing targeted promotions.

Effective training of sales staff plays a crucial part in this process, equipping them with necessary selling skills during high-demand periods.

Targeted Marketing and Sales Strategies

When selling seasons align with buyers’ preferences, one can prioritize high-demand products and develop effective cross-sell tactics. This alignment also enables focused marketing efforts on profitable customer segments.

This synchronization improves bottom line performance by reducing overstocking, optimizing inventory levels, and enhancing the efficiency of the sales process.

A link to Forbes article provides further insights on aligning selling seasons with customers’ buying preferences for profit maximization.

Risks of Selling Outside Peak Season

What Is the “Sell in May and Go Away” Strategy?

The “Sell in May and Go Away” strategy advises investors to sell their holdings during summer, and re-enter the market around Halloween. This suggests a potential drop in returns during these months.

What Are The Historical Trends?

Historically, the periods from May to October have shown lower returns. On average, the gain during these months is only 1.7% as opposed to the 6.9% return from November to April.

Is Selling During Summer Always Unfavorable?

Despite lower averages, returns during the summer months remain positive most of the time. In fact, losses were recorded in only 27 out of the last 80 May-October periods.

What About Market Timing?

Most analysts argue that timing the market is not practical. Instead of focusing on seasonal trends, long-term investments often yield more returns.

Is There A Preferred Time To Sell?

Certain investors may limit their divestment to May through August, when distractions and trading volumes typically decrease. However, it’s important to remember every situation is unique.

Are There Exceptions To The Rule?

In U.S Presidential election years, selling in May may not be advisable as strong summer rallies often occur, offering higher returns than average.

For more detailed information on this topic visit Investopedia.

Making the Most of Your Sale

Organizing all necessary documents is a crucial first step when preparing to sell your home. This includes your mortgage payoff statement, homeowners insurance, HOA documents, property tax records, and state disclosure forms.

Keep records of repairs and maintenance and provide receipts for taxes and other expenses. This demonstrates to potential buyers that you’ve taken proper care of the property.

Nothing deters potential buyers quite like clutter. By decluttering your living spaces, not only do you make your home more appealing, but you also free up space to enhance the perceived size of your home.

| Home Improvements | Cost | Recoup at Resale |

|---|---|---|

| Refinishing Hardwood Floors | $600-$1,000 | 100% |

| Installing New Wood Floors | $4,500-$5,000 | 91% |

| Upgrading Insulation | $600-$900 | 79% |

| Fresh Coat of Paint | $200-$300/room | 68% |

| Selling As-Is (No improvements) | $0 | Potential Lower Selling Price |

| Note: Costs are approximate and can vary based on various factors. Consider getting multiple quotes. | ||

Remember to put together a comprehensive plan and timeline for preparing the home for sale, including tasks like decluttering, packing, and finalizing documents.

Consider reaching out to a professional real estate agent. They can help with pricing the home appropriately and guide you through the process of selling your house in Texas.

Texas Selling Sweet Spot

Based on the past five years’ data, May emerges as the best month to sell a house in Texas. This period typically sees a surge in buyer demand, leading to competitive bids and higher selling prices. However, individual situations may vary, so it’s always beneficial to consult with a real estate professional.